Your monthly update on the state of the pork, poultry, beef, and seafood industries, direct from your Y. Hata category specialists.

Grocery

Frozen Potatoes

- 2023 Harvest is wrapping up across the US – harvest conditions have been mostly favorable. Temperatures have begun to cool. Digging should wrap up in October. Expected production is up 9.5% vs 2022 crop (as of 10/5/23 NAPMN – North American Potato Market News). Crop conditions are average to above average this year compared to low conditions from the previous 2 years.

- Good Yield and Good conditions will mean stable product availability and consistent supply for the upcoming year.

Frozen Vegetables

- The demand for frozen vegetables is rising due to growing consumer desire for ready-made and convenient food products. Changes in lifestyles and food habits as well as a rise in disposable income are expected to propel the growth of the market.

Canned Fruits & Vegetables

- The annual harvest for apricots, cherries, grapes, pears, peaches, mandarins, and organic pear tomatoes are complete. Conventional tomatoes are currently harvesting and are approximately 94.5% completed.

- Labor is still a challenge. Farms are challenged to retain sufficient seasonal workforce and skilled laborers. Companies are making investments in peeling/segmenting machines to reduce the number of laborers needed to process their harvest.

Cooking Oil & Shorting

- Corn and wheat yields are expected to come in as higher than forecasted.

- Soybean crop yields are anticipated to decrease in 2024.

- El Nino is expected to negatively affect wheat and other vegetable crops in the southern hemisphere which could potentially see an increase in exports.

- Anticipated demand for edible oils is expected to increase due to heart health benefits including olive, rapeseed, soybean, and sunflower seed oils.

Shelled Egg

- The state of shelled egg market is fluid. Producers in Washington, Oregon, and Nevada will be converting to 100% cage free beginning on January 1st, 2023. Colorado and several other states are expected to follow in 2025. Major producers continue to convert equipment and housing to meet legislative requirements for cage free.

- Avian flu has not had an impact on shell egg supply thus far.

- A few outbreaks of the avian flu have been reported in several turkey farms in the last month.

Calrose Rice

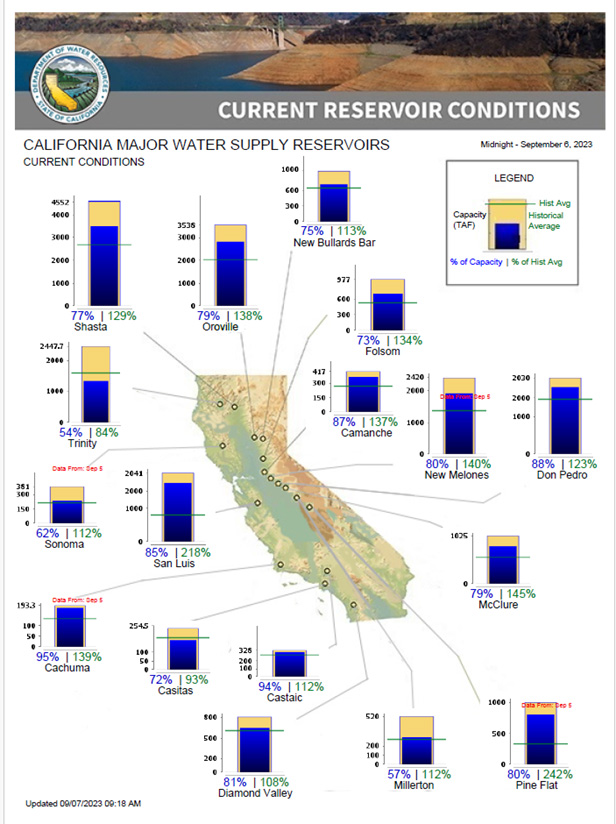

- The drought fueled water shortages in California has seen relief due to the historic amount of precipitation and snow received this past winter. California reservoirs Shasta and Oroville are near capacity leading to optimistic expectations for a bountiful crop in 2024.

Beef

With the holidays approaching, beef supplies continue to be limited due to the ongoing cattle shortage and persistent drought conditions. With herd rebuild yet to begin by ranchers, market-ready cattle supplies are expected to remain tight throughout 2024.

Despite higher prices and growing consumer pushback, beef continues to be popular among consumers which is supporting higher price levels for 2023.

Availability of premium (CAB, SS, & PSA) grade beef has improved slightly primarily due to consumer pushback. However, availability of both premium and prime grade beef is expected to tighten as we approach the holidays.

- Ribeye pricing has stabilized but will remain at higher price levels due to strong demand in both the retail and foodservice segments.

- Striploin pricing has been decreasing significantly over the past month and has returned to more reasonable price levels.

- Chuck flat pricing has decreased recently but will be increasing again next month due to overall strong demand in the chuck complex.

- Chuck roll pricing continues to remain strong as retailers are featuring more economical end cuts with budget conscious consumers in mind.

- Sliced beef short rib pricing continues to increase amidst the ongoing cattle shortage and less cattle being sent to slaughter.

- Oxtail prices are steady for now but could possibly increase further as we enter the colder winter months in many parts of the country.

For the remainder of 2023, we should expect elevated beef prices as these new high prices are now the norm. With cattle supplies expected to remain tight in 2024, what remains uncertain is how consumers will react to higher beef prices.

Poultry

With temperatures cooling off in many parts of the country, we are now seeing improved availability and higher live bird weights. Overall poultry supplies have improved to the point where we are starting to see decreased pricing for many chicken parts.

With beef prices at elevated levels, chicken is positioned to be the preeminent value alternative for consumers looking to stretch their limited grocery budgets.

- Bone-In Thighs – Availability for Bone-In Thighs has improved but we are still not seeing an abundance of offers due to ongoing labor issues at poultry plants.

- Boneless Skinless Thighs – Boneless Skinless Thigh prices will decrease significantly over the next month due to the improved supply of chicken.

- Leg Meat – Chicken leg meat prices which have been at elevated levels are finally starting to decrease albeit at a much slower pace than the thighs.

- Breast Meat – Breast Meat prices have been decreasing over the past few weeks but have started to firm up due to renewed retail demand.

- Wings – Wing prices, which were at historically low levels, have increased primarily due to stronger demand with the start of the NFL and college football seasons.

- Turkey – With wild bird migration picking up, we have seen the reemergence of the HPAI bird flu in multiple states and is something that will be monitored closely as we enter the winter months. Despite the recent outbreaks the overall supply of turkey remains good and there will be an adequate supply of turkeys to meet the upcoming Thanksgiving demand.

Pork

Overall pork prices remain at reasonable levels in comparison to higher priced proteins such as beef. With pork supplies more than adequate to meet current demand, prices are expected to remain stable for the time being.

California’s Proposition 12 legislation which was upheld by the Supreme Court on May 11th continues to be top of mind for the pork industry. Despite the momentary run up in prices prior to July 1st, as several California companies who “bought in” hoping to position themselves, pork prices have now returned to more reasonable levels.

- Butts – Boneless butt prices have stabilized and may decrease slightly over the next month as both retailers and consumers shift their focus to turkeys for the Thanksgiving holiday.

- Bellies – Belly demand and prices remain at higher levels, primarily due to Europe being short of inventory. Prices are expected to remain at their current levels for the next month.

- Back Ribs – Rib prices have stabilized and should remain steady for the remainder of 2023.

Pork & Poultry Outlook

Overall pork demand has increased but is at lower levels than 2022. Even at these lower price levels, pork still trails beef and poultry demand amongst consumers.

For the poultry industry, the overall supply for chicken has improved to the point where prices are decreasing for many chicken parts. What remains uncertain is where price levels will settle as the chicken industry aims to strike a balance between offering reasonable prices to consumers and allowing farmers to be profitable.

Seafood

Snow Crab

- The Alaska Department of Fish and Game has announced that the Alaskan Bering Sea Opilio Snow Crab Fishery will be CLOSED again for this 2023/2024 Season. The last open season was 2021/2022 with a quota of 5.6 million pounds.

- The next snow crab season will be in Canada, which is tentatively set to open April 20, 2024. Prices have strengthened for existing Canadian product remaining in storage from the 2023 season due to low supply and high holding costs. Product originating from the Gulf of St. Lawrence area is the most affected due to the popularity of the crab shell’s clean/bright color. Our current supply of 5/8 and 8/ups originates from this area.

Alaskan King Crab

- The Alaskan Bering Sea Red King Crab season is OPEN this year for fishing, running from October 15th through January 15, 2024.

- The Total Allowable Catch (TAC) is set at 2.5 million pounds Live Weight, which will equate to roughly 3 million pounds in section-based products (i.e., Legs and Claws). Pricing has not been set and we will not see Red King Crab available until the beginning of December.

- Pre-Ban Russian product is almost non-existent in availability from importers.

- The Gold King Crab season is ongoing, with a quota of 4.5 million pounds Live Weight, which will equate to approximately 3 million pounds in base product.

Cold Water Atlantic Lobster Tails

- The next large season for Cold Water Atlantic Lobster Tails is set to begin at the end of November off the coast of Southwest Nova Scotia (LFA Zone 33 and 34). There are some small zones still fishing with most of that catch is going to the Live Market, with China leading demand.

- Pricing and availability will be based on the strength of landings and weather conditions, which will not be known until the boats begin their fishing.

Tuna

- Pricing and availability are good for the present time.

- Currently Our containers for Poke Cubes are booked out through January with stable pricing.

Vanamei White Shrimp – Pier Port

- Prices remain stable for all sizes and types.

- Still a good opportunity to add another seafood item to your menu to increase profitability due to stable pricing.